Corporate-Level Strategy

What is corporate-level strategy and why is it important?

A corporate-level strategy specifies actions a firm takes to gain a competitive advantage by selecting and managing a group of different businesses competing in different product markets. Corporate-level strategies help companies to select new strategic positions — positions that are expected to increase the firm’s value. Firms use corporate-level strategies as a means to grow revenues and profits, but there can be additional strategic intents to growth. Moreover, effective firms carefully evaluate their growth options (including the different corporate-level strategies) before committing firm resources to any of them. Furthermore, corporate-level strategy is concerned with two key issues: in what product markets and businesses the firm should compete and how corporate headquarters should manage those businesses. Because of these reasons, it is important.

What are the different levels of diversification firms can pursue by using different corporate-level strategies?

1. Low Levels of Diversification

A firm pursuing a low level of diversification uses either a single- or a dominant-business, corporate-level diversification strategy. A single-business diversification strategy is a corporate-level strategy wherein the firm generates 95 percentage or more of its sales revenue from its core business area. Furthermore, with the dominant-business diversification strategy, the firm generates between 70 and 95 percentage of its total revenue within a single business area.

2. Moderate and High Levels of Diversification

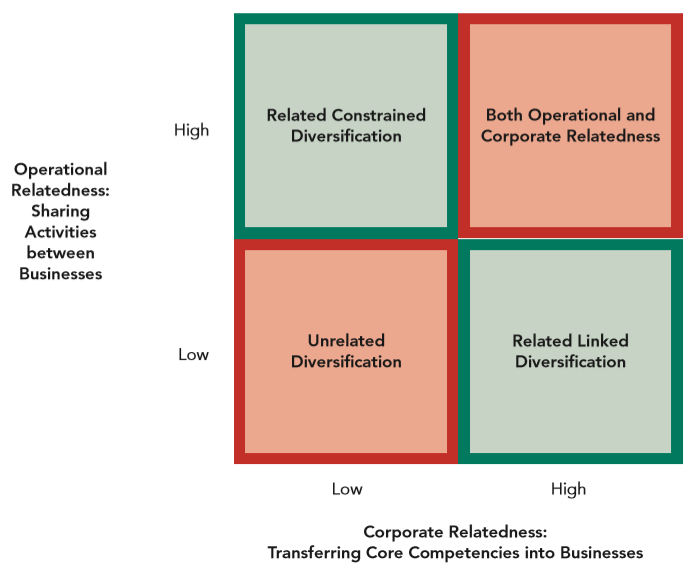

A firm pursuing a moderate and high level of diversification uses either a related constrained or a related linked, corporate-level diversification strategy. A firm generating more than 30 percentage of its revenue outside a dominant business and whose businesses are related to each other in some manner uses a related diversification corporate-level strategy. When the links between the diversified firm’s businesses are rather direct, meaning they use similar sourcing, throughput and outbound processes, it is a related constrained diversification strategy. Moreover, the diversified company with a portfolio of businesses that have only a few links between them is called a mixed related and unrelated firm and is using the related linked diversification strategy.

3. Very High Levels of Diversification

A highly diversified firm that has no relationships between its businesses follows an unrelated diversification strategy.

What are three reasons firms choose to diversify their operations?

· Value-Creating Diversification

· Value-Neutral Diversification

· Value-Reducing Diversification

How do firms create value when using a related diversification strategy?

Firms can create operational relatedness by sharing either a primary activity (e.g., inventory delivery systems) or a support activity (e.g., purchasing practices) discussion of the value chain. Firms using the related constrained diversification strategy share activities in order to create value.

Secondly, over time, the firm’s intangible resources, such as its know-how, become the foundation of core competencies. Corporate-level core competencies are complex sets of resources and capabilities that link different businesses, primarily through managerial and technological knowledge, experience, and expertise. Firms seeking to create value through corporate relatedness use the related linked diversification strategy.

Moreover, firms using a related diversification strategy may gain market power to create value when successfully using a related constrained or related linked strategy. Market power exists when a firm is able to sell its products above the existing competitive level or to reduce the costs of its primary and support activities below the competitive level, or both. Firms can foster increased market power through multipoint competition and vertical integration. Multipoint competition exists when two or more diversified firms simultaneously compete in the same product areas or geographical markets. Vertical integration exists when a company produces its own inputs (backward integration) or owns its own source of output distribution (forward integration).

Furthermore, some firms simultaneously seek operational and corporate relatedness to create economies of scope. The ability to simultaneously create economies of scope by sharing activities (operational relatedness) and transferring core competencies (corporate relatedness) is difficult for competitors to understand and learn how to imitate. This situation helps to the firm during the process of creating value.

What are the two ways to obtain financial economies when using an unrelated diversification strategy?

1. Efficient Internal Capital Market Allocation

In a market economy, capital markets are believed to efficiently allocate capital. Efficiency results as investors take equity positions (ownership) with high expected future cash-flow values. Capital is also allocated through debt as shareholders and debt holders try to improve the value of their investments by taking stakes in businesses with high growth and profitability prospects. In large diversified firms, the corporate headquarters office distributes capital to its businesses to create value for the overall corporation. Firms have used this approach to internal capital allocation among its unrelated business units. The nature of these distributions can generate gains from internal capital market allocations that exceed the gains that would accrue to shareholders as a result of capital being allocated by the external capital market.

2. Restructuring of Assets

Financial economies can also be created when firms learn how to create value by buying, restructuring, and then selling the restructured companies’ assets in the external market. As in the real estate business, buying assets at low prices, restructuring them, and selling them at a price that exceeds their cost generates a positive return on the firm’s invested capital. This is a strategy that has been taken up by private equity firms, who buy, restructure and then sell, often within a four or five year period. Unrelated diversified companies that pursue this strategy try to create financial economies by acquiring and restructuring other companies’ assets.

What incentives and resources encourage diversification?

1. Incentives

1.1. Value-Creating Incentives to Diversify

Value-creating incentives are single-business and dominant-business diversification strategies. I mentioned about what they are in the answer of second question.

1.2. Value-Neutral Incentives to Diversify

Incentives to diversify come from both the external environment and a firm’s internal environment. External incentives include antitrust regulations and tax laws. Internal incentives include low performance, uncertain future cash flows, and the pursuit of synergy, and reduction of risk for the firm.

1.2.1. Antitrust Regulation and Tax Laws

Government antitrust policies and tax laws provided incentives for firms to diversify. Antitrust laws prohibiting mergers that created increased market power (via either vertical or horizontal integration) were stringently enforced. Moreover, the tax effects of diversification stem not only from corporate tax changes, but also from individual tax rates. Some companies (especially mature ones) generate more cash from their operations than they can reinvest profitably.

1.2.2. Low Performance

Some research shows that low returns are related to greater levels of diversification. If high performance eliminates the need for greater diversification, then low performance may provide an incentive for diversification.

1.2.3. Uncertain Future Cash Flows

As a firm’s product line matures or is threatened, diversification may be an important defensive strategy. Small firms and companies in mature or maturing industries sometimes find it necessary to diversify for long-term survival. Diversifying into other product markets or into other businesses can reduce the uncertainty about a firm’s future cash flows.

1.2.4. Synergy and Firm Risk Reduction

Diversified firms pursuing economies of scope often have investments that are too inflexible to realize synergy among business units. As a result, a number of problems may arise. Synergy exists when the value created by business units working together exceeds the value that those same units create working independently. However, as a firm increases its relatedness among business units, it also increases its risk of corporate failure because synergy produces joint interdependence among businesses that constrains the firm’s flexibility to respond.

2. Resources

A firm must have the types and levels of resources and capabilities needed to successfully use a corporate-level diversification strategy. Although both tangible and intangible resources facilitate diversification, they vary in their ability to create value. Tangible resources usually include the plant and equipment necessary to produce a product and tend to be less-flexible assets. Any excess capacity often can be used only for closely related products, especially those requiring highly similar manufacturing technologies. On the other hand, intangible resources are more flexible than tangible physical assets in facilitating diversification. Although the sharing of tangible resources may induce diversification, intangible resources could encourage even more diversification.

What motives might encourage managers to over diversify their firm?

The desire for increased compensation and reduced managerial risk are two motives for top-level executives to diversify their firm. In slightly different words, top-level executives may diversify a firm in order to spread their own employment risk, as long as profitability does not suffer excessively.

In this post, the book at below was used.

https://www.amazon.com/Strategic-Management-Concepts-Competitiveness-Globalization/dp/1305502205